Did you know that 4 out of 10 students drop out of the online accounting course midway? As of Spring 2025, 266,507 students were enrolled in undergraduate coursework in the US. While this shows a whopping 12% increase in growth compared to the 2024-25 fiscal year, one must also note that dropout cases have increased as well.

When we investigated the reasons behind these dropout rates, we discovered that many students find it challenging to keep up with the rigorous demands of accounting education, especially in online or hybrid learning environments. The complexity of accounting principles, combined with poor study habits, lack of guidance, and limited practical exposure, often leads to burnout and disengagement.

This guide is designed to help you overcome those challenges and learn How to Become a Good Accounting Student. Whether you’re just starting your degree, preparing for the CPA exam, or planning your future career, these step-by-step strategies will help you build a strong academic foundation, develop professional skills, and cultivate the mindset needed to succeed in today’s competitive accounting world.

Table of Contents

Toggle

Step 1: Enroll in the Right Accounting Degree Program

The foundation of your accounting career begins with choosing the right accounting degree program. Look for accredited institutions that offer Bachelor’s or Master’s degrees in Accounting, Finance, or related fields. Accreditation by recognized bodies such as AACSB (Association to Advance Collegiate Schools of Business) or ACCA ensures the curriculum meets global accounting standards.

Before enrolling, evaluate course structures, faculty qualifications, internship opportunities, and alumni success rates. If you aim to sit for the CPA exam, verify that your program fulfills the credit-hour requirements. Choosing the right program early sets the tone for your professional credibility and future employability even then if you need help, Pay someone to take my online class is always there!

Step 2: Master the Art of Studying for Accounting Exams

Accounting exams demand analytical thinking, attention to detail, and conceptual clarity. Instead of rote memorization, focus on understanding the logic behind accounting principles. Use practice questions, mock exams, and real-world examples to apply theories effectively.

Develop a consistent study schedule that allocates time for review, problem-solving, and revision. Leverage digital tools like accounting websites, online tutorials, and practice platforms such as Becker or Wiley CPAexcel to strengthen weak areas. Remember, consistency beats cramming—especially when mastering subjects like cost accounting, taxation, and auditing.

Step 3: Build a Strong Professional Network Early

Networking is an underrated yet powerful tool for accounting students. Join student chapters of professional organizations such as AICPA, IMA, or your local accounting society. Attend seminars, webinars, and career fairs to connect with professionals and mentors.

Your peers, professors, and alumni can offer valuable insights into public accounting, internships, and career opportunities. A strong professional network can open doors to internships, job offers, and CPA mentorship programs—accelerating your career before graduation.

Step 4: Prepare for Certification and CPA Exams Strategically

The CPA (Certified Public Accountant) exam is a milestone for aspiring accountants. Begin your preparation early—ideally during your final year of study. Create a structured timeline that aligns with your coursework and professional goals.

Use reliable CPA exam prep resources, and practice under exam-like conditions. Balance your workload by setting weekly goals for each section—Audit (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment & Concepts (BEC). Passing the CPA exam not only validates your expertise but also boosts your earning potential and job security.

Step 5: Stay Current with Trends in Accounting and Technology

Accounting is evolving rapidly with digital transformation. Stay informed about emerging trends such as cloud accounting, data analytics, blockchain, and AI-driven auditing tools. Subscribe to reputable accounting websites like the Journal of Accountancy, Accounting Today, or The CPA Journal to stay updated.

Many employers now expect proficiency in accounting software like QuickBooks, Xero, or SAP, as well as data analysis tools such as Excel and Power BI. Being technologically adaptable demonstrates your readiness for modern accounting roles.

Step 6: Develop the Mindset of a Professional Accountant

Beyond technical knowledge, success in accounting depends on your professional mindset. Cultivate integrity, analytical thinking, and a commitment to accuracy. Accountants handle sensitive financial information—trust and ethics are non-negotiable.

Practice critical thinking and decision-making in every academic and real-world situation. Whether you pursue public accounting, private industry, or entrepreneurship, your professional attitude will set you apart from others, even if you Pay someone to take my online class.

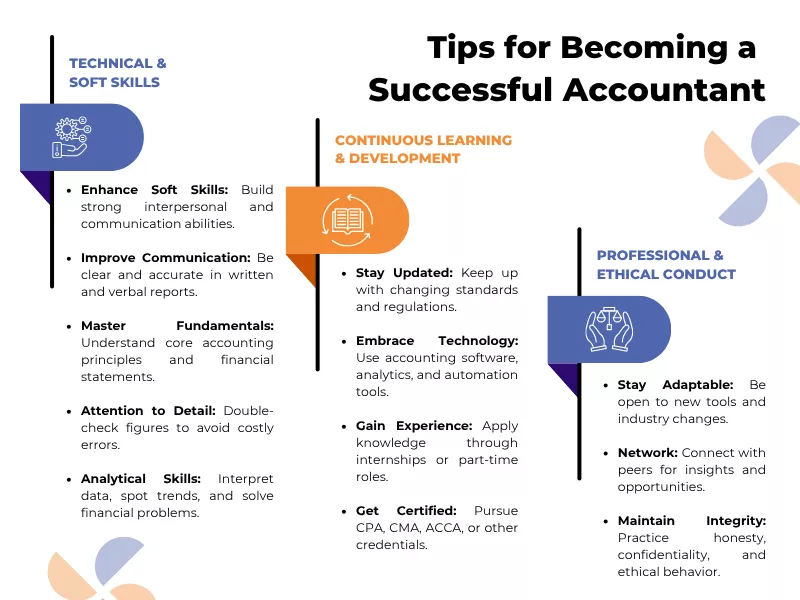

Tips on How to Become a Good Accountanting Student

Becoming a successful accountant takes more than just technical knowledge—it requires consistent effort, adaptability, and a balance of both hard and soft skills. Whether you’re an undergraduate exploring the accounting field or preparing to qualify as a CPA, this accounting student success guide, including tips for accounting students, will help you develop the habits and competencies that truly set professionals apart.

Technical and soft skills

Enhance Soft Skills:

Strong interpersonal and communication skills help you collaborate effectively with clients and colleagues, making complex financial information easy to understand.

Improve Communication:

Clear written and verbal communication ensures accuracy in reports and builds trust with clients and management.

Master the Fundamentals:

Build a solid grasp of accounting principles, financial statements, and regulations to create a reliable foundation for advanced learning.

Practice Attention to Detail:

Accuracy is crucial—small errors can have big consequences, so always double-check figures and reports.

Develop Analytical and Problem-solving Skills:

Use critical thinking to interpret data, identify trends, and make informed financial recommendations.

Continuous Learning and Development

Stay Updated:

Accounting standards and laws change often; keep learning through seminars, journals, and professional updates.

Embrace Technology:

Learn to use accounting software, data analytics tools, and automation to stay competitive and efficient.

Gain Practical Experience:

Internships or part-time roles provide real-world insights and help apply classroom knowledge in professional settings.

Pursue Professional Certifications:

Earning credentials like CPA, CMA, or ACCA boosts credibility and career opportunities.

Professional and ethical conduct

Stay Adaptable:

Be open to new methods, tools, and industry changes to remain relevant in a fast-evolving field.

Network with Peers:

Build relationships through professional associations, conferences, and online platforms to gain insights and opportunities.

Maintain Integrity and Ethics:

Uphold honesty, confidentiality, and fairness—ethical behavior builds long-term professional trust and reputation.

Furthermore, you can get help with Accounting class when you feel stuck.

Conclusion: From Accounting Student to Successful Accountant

So, how to pass accounting exams? Becoming a successful accounting student and ultimately, a competent accountant requires more than just mastering numbers. It’s about developing a balance of technical expertise, professional ethics, and lifelong learning habits. By enrolling in the right program, maintaining a disciplined study routine, networking early, and staying updated with technological and industry trends, you set yourself apart from the competition.

Remember, accounting is a field built on trust, accuracy, and continuous growth. Every concept you learn, exam you pass, and connection you make brings you one step closer to a rewarding career. Stay focused, stay curious, and never hesitate to seek help when needed—because success in accounting isn’t just about passing exams, but about building a foundation for excellence that lasts a lifetime.

Frequently Asked Questions

What Is Public Accounting, And How Is It Different from Private Accounting?

Public accounting is one of the most important branches of the accounting industry, where professionals offer auditing, tax accounting, and advisory services to multiple clients. In contrast, private or management accounting focuses on analyzing and managing a single company’s finances. Many accounting professionals with a bachelor’s degree in accounting in the U.S. begin in public accounting before specializing in fields like forensic accounting or becoming certified management accountants after gaining at least two years of experience.

Why Should Accounting Students Consider a Career in Public Accounting?

A career in public accounting allows students to gain exposure to various industries, clients, and reporting systems. It is one of the most important steps toward your career if you aim to take the CPA exam or pursue graduate-level roles. The Bureau of Labor Statistics highlights strong employment opportunities for CPAs, especially in auditing and management accounting. After earning a bachelor’s degree in accounting and gaining two years of experience, professionals can advance into leadership or forensic examiner positions.

How Can Accounting Websites Help Students Stay Current in the Field?

Trusted accounting websites guide students and recent graduates in staying informed about regulatory changes, management accounting techniques, study techniques for accounting majors, and career pathways in the world of accounting. Sites like Accounting Today, AICPA, and IFAC publish expert insights on new technologies, forensic examination, and certified information systems auditor updates. These resources help students enhance their professional readiness, understand extra credits needed for CPA certification, and find employment opportunities that align with their specialization and years of work experience.

How Can Accounting Students Build Analytical Skills Effectively?

No need to wonder how to improve in accounting, to improve comprehension and analytical ability, students must go beyond textbooks and engage in real-world simulation exercises. Many accounting programs allow students to work on financial case studies that mimic management accountants’ daily challenges. Using data analysis software, working under industry professionals, and pursuing certifications such as CPA or CISA (Certified Information Systems Auditor) can greatly enhance understanding. Consistent practice helps students achieve success in coursework, internships, and later, the CPA certification process.

Which Accounting Websites Are Best for Students to Learn From?

Reliable resources like the Journal of Accountancy, AICPA, and the Institute of Internal Auditors provide trusted guidance for recent graduates and students pursuing a bachelor of science in accounting. These platforms publish preparatory content to help learners take the CPA exam, stay informed about financial challenges, and explore specialization options like management accounting or forensic examination. Regular reading of these sites helps students find employment faster and stay aligned with education requirements and industry standards.

How Do Analytical Skills Help in Passing the CPA Exam?

Analytical reasoning plays a major role in mastering the CPA certification process. The exam uses simulation tasks that test a candidate’s ability to evaluate data and solve complex accounting scenarios. Strong analytical comprehension allows CPAs to detect inconsistencies, interpret standards, and make ethical financial decisions. Developing these skills during your bachelor’s degree in accounting—especially through preparatory and graduate-level coursework—helps candidates meet education requirements and perform confidently across all sections of the CPA exam.